Negotiate by definition is to deal or bargain with others in preparation of a contract or business deal. As a verb, negotiate means to move through in a satisfactory manner. In the world of selling, both of those definitions are relevant and important. Oftentimes, sales negotiation tactics seem to be related to price – giving or getting the best rate or fees for a product or service. Here is what we know to be true about rate or price reduction requests. We call them the 3 Immutable Truths:

- It does not cost your prospect or client anything to ask for a better deal

- Your tone and response will set the tone for future negotiations

- If you don’t move the conversation away from rate towards value, you will always be negotiating rate

To respond effectively to a rate or price requestion, you must be assertive, skilled at asking questions and listening, able to sell your value and a skilled negotiator. Skillful salespeople know how to do all this and bring that additional layer of consultation to bring the negotiation to its best outcome.

We are often asked about training on sales negotiation tactics and while important, the real strength of elite producers is in this area of being inquisitive, curious, caring and consultative. While negotiating is all about landing on an agreed upon “fair deal” for the prospect and service provider, consulting is much more. A consultative seller will come prepared to a meeting fully understanding many of the possible issues a company may have and industry trends and challenges. Elite producers even have their questions laid out, tailored for resonance and possible questions that their prospect may ask of them. These are very basic skills of a consultative seller and can be accomplished with a pre-call plan.

But top bankers, insurance providers and financial service providers come to the table with much more than preparation and sales negotiation tactics. Their questions stem from an inherent desire and need to know more, an open curiosity about the challenges a business owner may have and the yen to know more and to connect solutions with problems, even if it is not their own solution. They are just genuinely interested and surprisingly, they are also humble and not boastful of what they do and offer their clients. Rather, they are confident about themselves and their company and empathetic in their approach. With their skillful question and listening abilities, they are able to help their prospects and clients self discover what needs to happen to solve their business problem.

A consultative approach often leads to an advisory role and, in most cases, that is what financial service providers are striving to accomplish with their clients. If they can become a trusted advisor, they can really help their clients on a much broader level than a product or service. They will become part of the inner trusted circle for change and growth for that business leader. While sales negotiation tactics are important and lead to a satisfactory arrangement, a truly consultative seller is an essential part of the success of any business and the end goal is overachievement of goals and enhanced profitability.

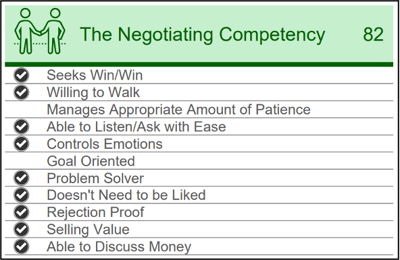

Referencing the data from the #1 sales assessment in the world, by Objective Management Group, there are some similarities and differences in the specific skills for a negotiator and consultative seller. Here are the skills that strong negotiators have mastered:

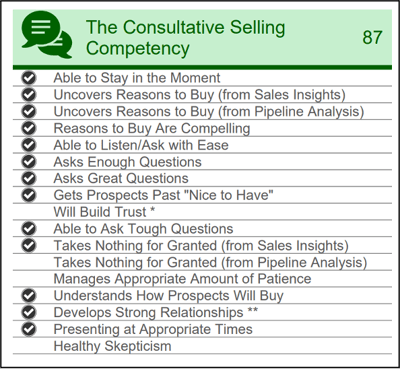

Now let’s take a look at the skills of the Consultative Seller:

So, let’s revisit that initial question, how strong are your salespeople at negotiating and consultative selling? Don’t you need to know this? Here’s how to find out now.