What Is a Prospect’s “Love Language”?

Prospects don’t respond well when salespeople fail to tailor their message for resonance. In other terms, that means your salespeople are not speaking the prospect’s love language.

A prospect’s love language comes down to two things:

- The problems or challenges they are dealing with right now

- The future growth opportunities they see on the horizon

When your salespeople lead with anything other than those two areas, they risk wasting the prospect’s time and missing the opportunity to move the relationship forward.

Salespeople often fall into the trap of leading with product features, company history, or generic value statements. What prospects care about is whether your salesperson understands their world and can help solve real problems or support real goals.

That is where many sales conversations go off track.

The Two Challenges Facing Financial Services Sales Teams

As a national sales training and coaching firm, Anthony Cole Training Group has a front-row seat to what is happening inside financial services sales teams across the country. Two challenges consistently rise to the top.

1. Fewer Quality Prospect Meetings

With fewer face-to-face meetings over the past several years, many salespeople have struggled to adapt their relationship-building skills to a virtual environment. Resistance to meetings has increased, and too many salespeople do not know how to work through that resistance.

The result is fewer quality conversations and fewer opportunities entering the early stages of the pipeline.

2. Margin Erosion at the Finish Line

When a deal finally starts moving forward, many salespeople become overly focused on simply getting it across the finish line. They cave on rate or price to close rather than protecting value.

Over time, this behavior erodes margin and conditions prospects to expect concessions.

So, guess what? We lead with those two things… and nothing else. Because those are the issues prospects actually care about.

Prospects are far more willing to engage when they feel understood. When your salespeople speak directly to a prospect’s challenges and growth objectives, they immediately separate themselves from competitors. They become relevant. They earn the right to continue the conversation.

Coaching for Relevance and Results

Too many sales teams still operate with a “hope strategy.” They hope prospects will be interested. They hope meetings will go well. They hope deals will close.

High-performing sales organizations do not rely on hope. They coach their salespeople to lead with purpose, preparation, and messaging that resonates.

- If you want more meetings, coach your salespeople to lead with what matters to prospects.

- If you want stronger pipelines, reinforce early-stage activity.

-

If you want healthier margins, hold your team accountable for selling on value instead of price.

Teach your salespeople to lead with prospect priorities, and you’ll build stronger relationships, healthier pipelines, and more consistent growth.

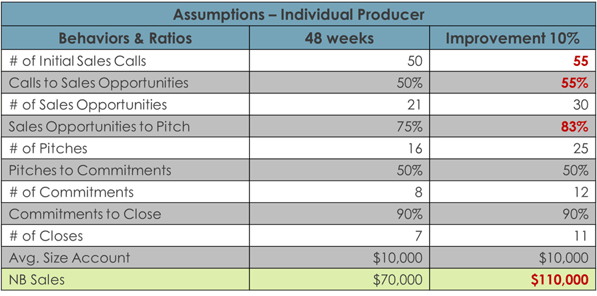

Register for our upcoming live webinar to learn why top lenders drive up to 10x more revenue than bottom performers and uncover the four qualities that define diamond-level relationship managers! You’ll gain practical insights on developing stronger producers and access a free tool to benchmark your team’s relationship-building skills. Free registration, recording provided.

Ready to develop stronger relationship-building skills across your sales team? Download our free eBook The Relationship Selling Guide for proven strategies and frameworks, or contact Anthony Cole Training Group to learn how our assessments and coaching can transform your team's ability to build rapport and close more business.

-2.png?width=500&height=500&name=free%20download%20(1000%20x%201000%20px)-2.png)

-2.png?width=400&height=400&name=free%20download%20(1000%20x%201000%20px)-2.png)