What prompted this article was a post from Jeff Ferraris, a program manager for CUSO Financial Services in Austin,Texas. The article – "Leading With Planning: Master Financial Planning With These 6 Steps" – takes investment advisors through a best practices process to have success implementing financial plans for high net worth clients. Aside from the ‘know how’ and the licensing required, what else do your advisors need in order to be successful in their role?

There are many answers to that question but generally speaking they need to have these sales capabilities:

- Hunting

- Qualifying

- Being a Consultative Seller

- Presenting

- Closing

- Farming or account managing

Need to know how your team measures up against the

best in your industry?

Click here to access Objective Management Group's Stat Finder.

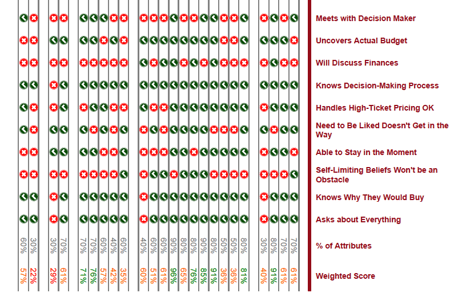

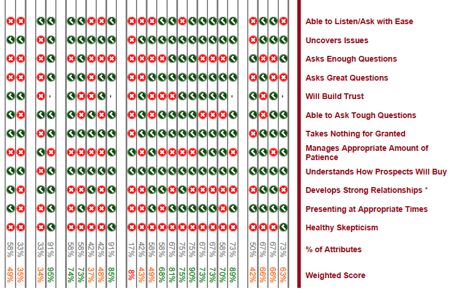

I’m going to focus on the skills required for success when qualifying and selling consultatively. Below are two charts of the competencies necessary to be successful in these two capabilities.

The Qualifier Skill Set

The Consultative Seller Skill Set

As you can see there are multiple skills that make up the competencies for Qualifying and Consultative skill sets. In this scenario, and not unusual in general, of the 55 salespeople evaluated, 22% of the group had enough consultative skills to be effective and only 30% had enough qualifier skills to be effective.

What impact does this lack of skill in these two areas have on investment advisors and the ability to successfully execute a strategy of using financial plans? Broker dealers that are attempting to help clients improve both the quantity and quality of their plans must get to the root cause of the problem.

Here are the 3 BIG weaknesses in the Qualifier Competency:

- Talking to the decision maker: if your investment advisor fails to meet with the decision maker– UP FRONT– then it will impact the sales cycle duration and the closing ratio.

- Uncomfortable talking about money: Investment advisors often don't have to worry about discussing money. If you think about the challenges your advisors face when presenting a financial solution, many don’t close opportunities for risk products because they encounter a money objection and aren’t comfortable talking through price.

- Self–limiting beliefs: If your advisors don’t have a financial plan, if they don’t own individual disability or long-term care insurance, if they are way under insured for life insurance, how committed do you think they will be recommending it to a client?

And here are the 3 BIG weaknesses in the Consultative Seller Competency:

- Ask enough questions– Executing the financial plan process is more than asking how much. The effective IA must ask a ton of “why” questions.

- Demonstrates patience– The very nature of most advisors is to close the sale they have in front of them– the transaction for the IRA roll-over. How does that support the 90-day process of financial planning? It doesn’t.

- Maintain healthy skepticism– If your IA believes everything the client is telling them then they will never ask about other advisors, the other assets, the real decision-making process, etc. So instead of a 6x multiple from doing plans they will pick up the easy money from the next maturing CD.

To find out more about how to effectively identify those advisors ‘wired’ for fee-based sales and financial planning, email alex@anthonycoletraining.com, subject line "tailored fit", to create your own case study by evaluating your top advisors.