Recruiting better talent is the biggest problem identified by most bank CEOs, especially as it relates to critical sales roles. Given the emergence of AI and the increasingly digital aspect of banking and insurance, it is an even greater problem for many financial services companies. Here are the 5 most common reasons most companies struggle with hiring quality talent such as relationship managers, lenders, and producers.

#1 Outsourcing the Responsibility for Recruiting Talent in Financial Services

They outsource their recruiting and the responsibility. Recruiting is something that financial services firms must own. Be cautious of outsourcing the work and the responsibility. That makes it too easy for people internally to throw up their hands and transfer failures associated with the hiring process to the outsourced firm. In order to recruit better talent in financial services, companies have to own the process.

#2 Lack of a Consistent Recruiting Process

There is a lack of a consistent process for constantly searching. Most, if not all, banks and insurance firms make the mistake of looking for candidates only when they have an opening. This leads to many problems:

-

They are held hostage by producers with “large books.” Managers feel they cannot do anything about them for fear of losing the “books” since they do not have any replacements.

-

They feel desperate to fill a chair with a warm bottom when there is a vacancy. A body, any body, is better than no one sitting in the chair.

-

They do not replace underperformers because there isn’t a pipeline of candidates to choose from. The underperformers stay around too long; others know it and realize that they don’t have to perform that well to keep their job, so overall team production continues to decline.

#3 Poor Candidate Qualification in Financial Services Recruiting

Financial services companies are not getting quality candidates entering the process. The traditional model of recruiting today involves the placement firm trying to convince the financial services company why a candidate should be hired. Companies should, on the other hand, work extremely hard to disqualify candidates because there are specific skills that apply to that sales job and many or most candidates do not have those skills.

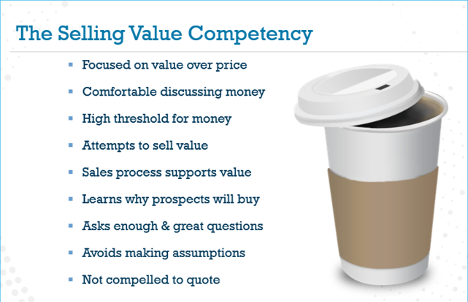

Bottom line, the company has to assess at least two things:

- Does the candidate have enough of the right strengths to be successful?

- Will they sell versus can they sell?

Here’s some information on how to find out if your candidate will sell.

#4 Poor Communication About Sales Role Expectations

There is poor communication about the specific role and expectations of this new hire. Too often, everyone is so excited about getting the seat filled that no one takes the time to get into the details of the day-to-day requirements of the job. This leads to early misunderstandings about the role and, eventually, failure on the part of the new hire to meet the expectations of the company. Failure to “negotiate on the 1st tee” leads to misunderstanding and failure to execute on the sales goals.

#5 Inadequate Onboarding for Sales Professionals

The onboarding process is inadequate in the area of selling. Most companies are ill-equipped to effectively onboard new salespeople. They spend time introducing them to the “culture” of the operation, the mechanics of the job, and how to get things done. They introduce them to HR, their support team, marketing, and their partners. And, yes, there is discussion about goals, sales activities, and how to enter data into CRM. And then… the new hires are on their own.

Banks and insurance firms think that they have hired their next sales superstar and then, 12 months later, they cannot figure out what went wrong. They look at the numbers and discover that the new hires are producing “just like everyone else in the middle of the pack.” The process many have in place currently to recruit and hire salespeople perpetuates this problem.

Need Help Recruiting Talent in Financial Services?

If you need help or more information on recruiting better talent, we have many resources available for you. You can start with our eBook on the topic:

How to Hire Bankers Who Will Sell

Register for our upcoming live webinar to learn why top lenders drive up to 10x more revenue than bottom performers and uncover the four qualities that define diamond-level relationship managers! You’ll gain practical insights on developing stronger producers and access a free tool to benchmark your team’s relationship-building skills. Free registration, recording provided.

Ready to develop stronger relationship-building skills across your sales team? Download our free eBook The Relationship Selling Guide for proven strategies and frameworks, or contact Anthony Cole Training Group to learn how our assessments and coaching can transform your team's ability to build rapport and close more business.

-2.png?width=500&height=500&name=free%20download%20(1000%20x%201000%20px)-2.png)