Of course you have sales problems. If it’s not a production problem, it’s a productivity problem. If it’s not a productivity problem, it’s a servicing problem.

If It’s not a service problem, it’s a sales/sales support turnover problem. But, how do you help ease the pain and start to fix things?

.jpg?width=1920&name=board-game-businessman-challenge-1040157%20(1).jpg)

In the words of Rosanne Rosannadana, “It’s Always Something”

Most companies, if not all companies, have some method for keeping and tracking sales pipeline activity and progress. We use Hubspot’s CRM because it ties in very well with our inbound lead efforts, the pricing is extraordinary, the reporting is as good as anything on the market and getting up to speed is fast and easy. But, putting data in the CRM and keeping an eye on it, is not enough.

You have to gain business intelligence and then act on what you know.

Conduct an Emergency Pipeline Anaylsis (EPA) for a simple but effective way to determine what stays in the pipeline and what goes to the pipedream (delete folder). EPA originator, Dave Kurlan, wrote a blog that goes into detail about the 16,000+ proposals presented to unqualified buyers by B2B salespeople every day. This data comes from the 1,000s of Sale Evaluations and Improvement Analysis (SEIA) done yearly by our firm and others around the world.

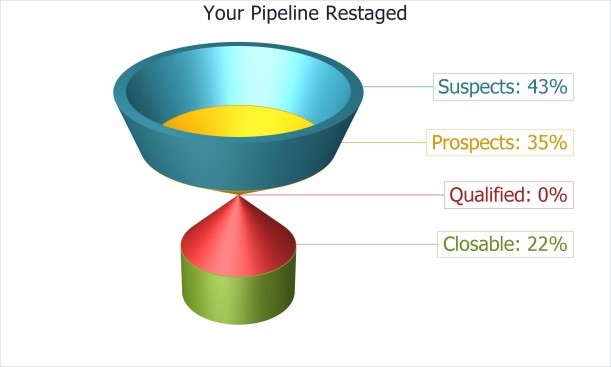

In the SEIA, we analyze the state of the current pipeline. Figure 1 identifies the quality of the pipeline assessed for a large sales organization. When assessing for closable opportunities, the green area at the bottom should be much larger than the blue area at the top, if the opportunities are truly qualified. If your closable opportunities are not really qualified, you end up with a similar pipeline configuration to the one you see in the chart.

Figure 1

Figure 1

The process to get this information is simple, but effective: Create a number of qualifying questions that are based on the steps in your qualification checklist. Those questions may include but are not limited to:

- Is there severe mental anguish to make a purchase/change and is it personal?

- Did I attach value or monetize the problem or failure to leverage the opportunity?

- Did I eliminate the incumbent?

- Did I ask, “Is this a have to fix or want to fix problem”, and did the prospect say "have to fix"?

- Did they agree to invest the appropriate amount of time, money and resources?

- Due I have a date of execution, purchase, contract?

- I have met with the decision makers (not I will be meeting with decision makers at time of presentation) and they have agreed to make a decision when I finish my presentation.

- I rehearsed the prospect on what they will do when the incumbent returns to beg for the business, fix the problems and match our fees, structure, contract.

Answering/scoring these questions simply requires a 1 or a 0. You add up the scores vertically for the opportunities in your pipeline and then make a decision to either;

- Call your prospect and deal with the open items.

- Reconcile that you have asked these questions and didn’t get the right answers and therefore make the ‘go, no-go’ decision to present.

There is a world of difference between managing the pipeline and looking at the pipeline and reporting the results. Managing is an active process. As a manager you must constantly and consistently evaluate the opportunities in the pipeline for:

- Quality – are they true opportunities?

- Quantity – the number and value volume must match each individuals success formula

- Movement – based on your buyers’ buying cycle you should be able to predict movement from one step in the process to the next

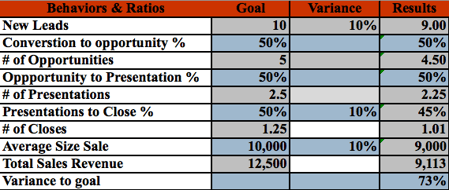

- Measure the conversion ratios from one step to the next to evaluate effectiveness of the sales person’s execution of the process

- Evaluate for credibility and validity

- Credibility – did the projected close volume actually close?

- Validity – did the accounts in the pipeline actually close and account for the volume forecast and actual sales?

This will take time but it’s important for you and your salespeople to do because it will ultimately result in closing more business, more quickly at higher margins.