In all moments of selling, there are many things that can go wrong. And when something goes wrong, it is in fact time to say “Houston, we have a problem.” But who is the “we” that caused the problem?

How to Avoid Selling on Price

I have always loved President Theodore Roosevelt’s quote on problems: “If you could kick the person in the pants who is most responsible for most of your trouble you would not sit for a month.” Just like in tennis or golf, many of our problems are self-induced. They are “unforced errors.”

Our sales coaches, we are always dealing with sales challenges that span the entirety of the typical sales process. From the opening moments of finding a lead to uncovering an opportunity to presenting and getting a decision, there are many things that can go wrong. And when something goes wrong, it is in fact time to say “Houston, we have a problem.” But who is the “we” that caused the problem?

Speaking of Houston, I was there this week delivering a keynote address at the 2022 Mid America Lenders Conference. My training was on selling in a rate-sensitive environment which is a hot topic given that 2022 will be a year with multiple rate increases. In my keynote, I asked the attendees if they were working on the right end or the wrong end of the problem. When a prospect asks you at the end of the sales process for a concession (rate or terms), that tends to be a real trouble spot for salespeople.

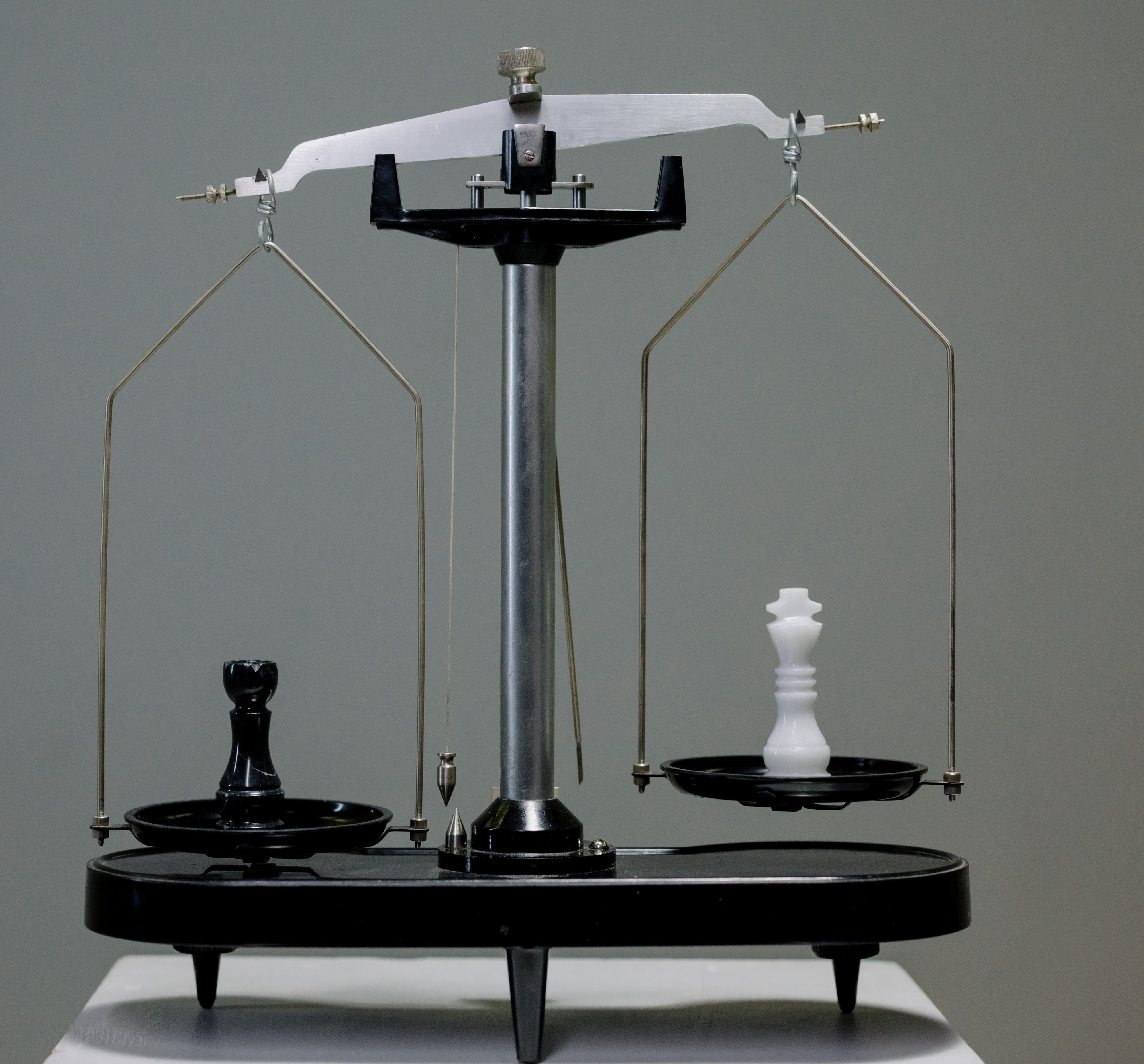

Every company we work with believes in the power of having a value-based selling approach. None of them want to be the low-cost provider in their respective industry. And while we are called upon to help with last-minute or late-cycle negotiations, that is working on the wrong end of the problem. The right end of the problem is at the beginning of the sales process where it is essential to introduce value into the equation. After all, the primary reason why salespeople struggle to defend value at the end of the sales process is that they fail to introduce that value at the beginning of the sales process.

From the sales assessment tool that we use by Objective Management Group, here are the skills of a value-based seller:

- Focused on value over price

- Comfortable discussing money

- High threshold for money

- Willing to walk if the prospect does not see value

- Always positions value

- Sales process supports value

- Learns why prospects will buy

- Doesn’t need approval

- Asks enough & great questions

- Avoids making assumptions

- Quickly develops rapport

- Not compelled to quote

Start helping yourself by positioning your value early. Make it impossible for your prospect to miss it. Find out if your prospect values it and protect your bottom line.