Your potential sales candidates have to have a successful history selling the way your company sells, to the people you sell to, in the environment you sell in.

In the 5th installment of our blog series, No Assembly Required Hiring, we discuss the importance of recruiting salespeople who not only fit your selling requirements but also match the specific criteria of your organization.

You believe you recruited Wonder Woman: someone with a great resume, OMG findings that showed strong Will to Sell, great Sales DNA, and they scored well in Sales Competencies. You could reasonably expect Wonder-Woman-level sales results. However, 12 to 18 months later, the results you see more closely resemble Aquaman (the 1967 version- not the new and improved Jason Momoa model).

So what happened?

There could be a couple of explanations:

- All salespeople need coaching – it could be that your sales manager is great at managing performance but not at coaching.

- The onboarding process didn’t address some of the findings that needed work in either the Sales DNA or Sales Competencies categories.

- The OMG is 92% predictive – you may have hired 1 of the 8 that got through.

- Or, and this is the topic for our discussion today, it could be that there was a poor role fit.

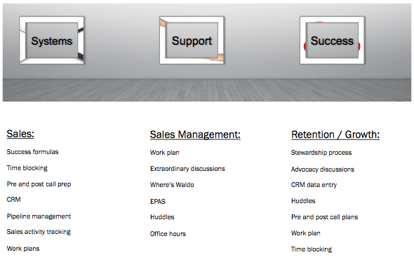

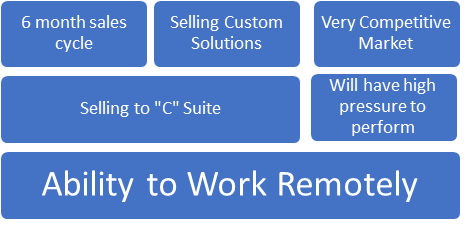

When using and establishing the OMG pre-hire assessment, the sales executive answers a series of questions about the environment that exists within the company and what is required to be successful in that environment. The questions asked revolve around, but are not limited to, areas like the following:

If this is what it takes to succeed in your organization, and your candidate doesn't have success selling within your environment, they will struggle despite the Will to Sell, Sales DNA, and Sales Competencies. When we see overall strong results, but there is a mismatch with your criteria, “Recommended for Hire" doesn’t mean hire! You have to be ready to take on a project, adjust your onboarding expectations, increase the frequency of coaching, and change the type of coaching you would typically conduct.

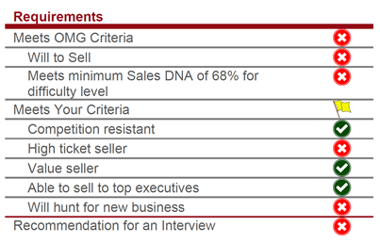

Here is a sample from the pre-hire assessment that provides information about role match:

Imagine for a minute that the candidate did meet OMG Criteria scores for the Will to Sell and Sales DNA. There would still be a yellow flag in the category of Meets your Criteria if the candidate didn’t answer the questions the same way you did for role experience. This example tells you that your candidate wasn't successful as a high ticket seller, and they will not hunt for new business. This is a mild case of mismatched historical success and predicted success for your organization.

Over 25 years ago, we got our start on the big stage with USI Insurance. Back then the focus of that company, and many in the insurance brokerage industry, was organic growth from current salespeople and occasionally hiring a hotshot broker from one of the larger firms. They looked for brokers that would bring a high level of experience to the firm and possibly bring some large accounts with them.

Often these highly touted recruits would fail. Why? Because the environment for success was different. They didn’t have a business card that had the name of a company that was easy to defend if something went wrong. Their success was based on the ability to show a card that said Aon or Marsh. In addition to having the right stuff, your candidates have to have a successful history selling the way your company sells, to the people you sell to, in the environment you sell in.

They have to be a fit, and they have to be coachable. As you think about your next hire, think about the reasons people have failed in the past. Structure your recruiting, vetting, and onboarding process to uncover problems early and/or address them if you decide to take on a project.