For centuries, community banks have invested in their local communities and promoted relationship banking. They have been founded on the bank's knowledge of community families, their spending histories, or their small business's finances. Enter the world of high-speed tech, digital banks and AI, offering options never even dreamed about ten years back. Protection of those community bank roots is critical – to take care of the people in the community they serve. How do community banks offer a non-disruptive transformational approach to leverage all of these tech options yet still serve the client in a personal, relationship banking manner?

Drawing from this recent article in Inc., How to Revitalize Your Industry Without Needing to Disrupt It, “Non-disruptive transformation is a journey back to the roots, where the customer is not merely a transaction but the focal point of every endeavor. As industries evolve, this approach offers a blueprint for sustainable growth, ensuring that innovation serves the fundamental purpose of meeting customer needs and enhancing their experience.”

While all financial institutions are heavily investing in the technology necessary to stay competitive and viable in today’s virtual world, the community bank must not lose site of it's original mission to personally serve that client. At the other end of those tech systems and data are the frontline people in your bank and answering your customer service lines. Are they as skilled as they can be to have engaging conversations? Are they skilled enough to listen to learn, probe for deeper understanding, not pitch solutions too soon and become financial guides for their clients and prospects? That is the role of the new community bank. To leverage all of the information at their fingertips, provide seamless knowledge and advice in a holistic and personal manner for their local families and businesses.

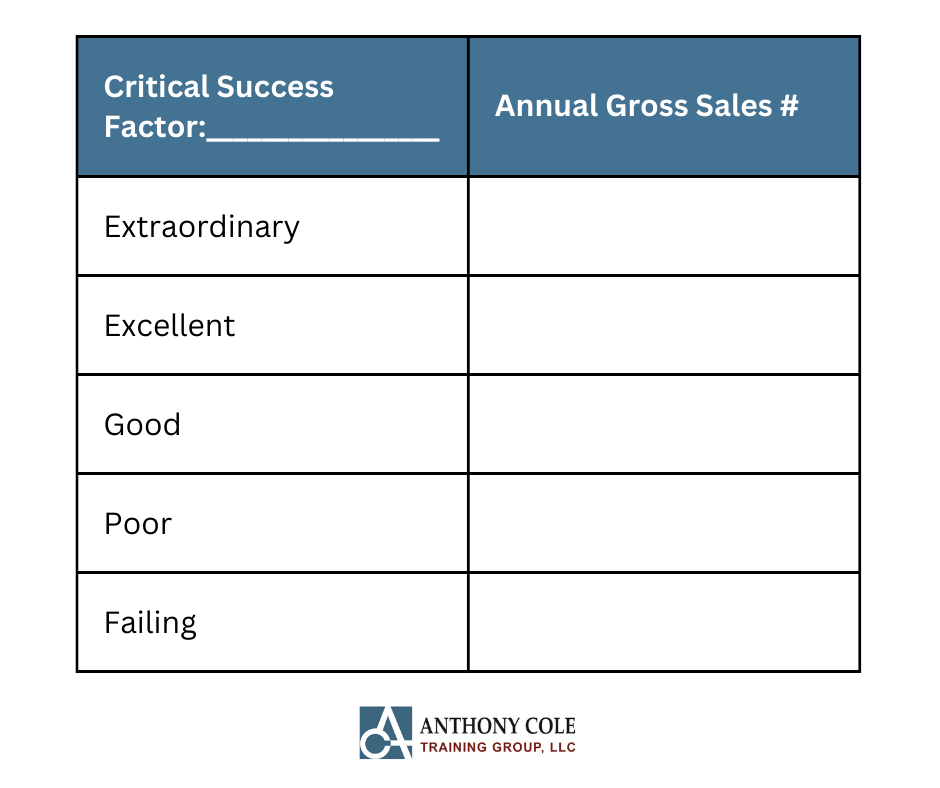

To do this in a non-disruptive way, banks can focus on developing their people, their most important asset. As you hire and bring new people in the door, make certain that they have the skills to ask those courageous questions and delve deeper. It may require an investment to upgrade the skill levels of those who work in the local branch and operate in a business development role, developing them to a great level of advisory service.

Drawing from the Inc. article again; “In the ever-evolving landscape of industries, non-disruptive transformation emerges as a strategic and sustainable approach to innovation. Businesses can carve out a niche while maintaining continuity and stability by focusing on fundamental tasks, breaking the status quo, and returning to the industry's original concept.”

Success in the future for community banks lies in aligning and differentiating with the core values that have defined the industry's essence for centuries.