As the story goes, Chicken Little gets hit on the head and declares the sky is falling.

As the story goes, Chicken Little gets hit on the head and declares the sky is falling.

Last spring, the Department of Labor passed new fiduciary regulations on the financial advisory business, and since then, there have been an untold number of articles written about the impact on advisors, the industry and consumers. Several of these have stated that:

- Trillions of dollars will saved in investor commissions because advisors will soon be held to a much stricter fiduciary standard that affects transactional incentives.

- Advisors will lose ½ of their revenue because what was a solid investment recommendation and seen as ‘suitable’ will soon be considered conflicted advice because it paid them commission.

- The industry is in turmoil as it attempts to figure out how to meet DoL regs, hold on to high-performing advisors and effectively make-up the assumed lost revenue.

The sky is falling?!?

I read Bank Investment Consultant at least 3 times a week. The publication and its editors/authors do a great job of keeping people connected to the industry in the loop on the latest changes, trends and thought leadership. Lee Conrad, Editor of Bank Investment Consultant, recently wrote an article titled: Bank Advisers: Prepare to Cut Your Book by Half

Here are a couple of excerpts from the article:

The fiduciary rule will require most bank advisors to trim their books of business to a much more manageable level. How much is really a guessing game at this point. But, for many advisors, especially those who have focused on transactional business, it will be significant.

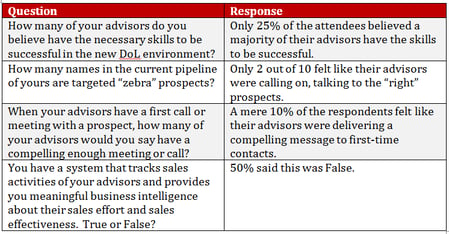

This was just one of the discussions from our last Industry Leadership Forum in Denver. We hold these meetings in conjunction with Stathis Partners as small, invitation-only gatherings for industry execs to discuss the top issues on their radar screens.

So, how many clients can an advisor reasonably manage when they are acting in a fiduciary capacity? The numbers bandied about in our meeting were in the low hundreds: about 200 give or take.

***

REALITY CHECK

How many clients do advisors really have? Consider some research we did earlier this year for our annual Top Program Managers ranking. In addition to asking each nominee how many advisors they had on their teams, we also asked how many households their teams served. We've never used those results until now, but the average was 750 client households per advisor. The median was a bit lower--about 550--but many of the individual programs had well over 1,000 clients per advisor.

***

TEE-UP THE CROSS SELL

Here's one more assumption, on my part, that I feel pretty good about: Advisors don't want to lose too much of their pay. If they generated, say $200,000 in annual production in 2016 and next year they find themselves with a book of business that's been cut by half, the natural move for them will be to get more profit from each client. (Just how to segment a book was another discussion at our forum, which we'll write about in a future installment.)

So, here is the first thing you should keep in mind about Dol and its impact:

It’s easy to get caught in the DoL quicksand. Two friends of mine who also happen to be well -respected people in the industry, Michael Graham from Midwest Securities Trading Company and Kevin Mummau from CUSO, are not panicking. Actually, we all seem to agree that this is a great opportunity for advisors:

- The money hasn’t gone anywhere.

- Advisors that aren’t very good at really advising clients and struggle with “fiduciary” standards will leave the business.

- The solutions to the “problems of revenue loss” already exist: financial planning and risk management products.

So, is the sky really falling? We will answer that question in our next post!